Make Money Trading Cryptocurrency: A Comprehensive Guide

Introduction to Cryptocurrency Trading

In recent years, the cryptocurrency market has exploded into the mainstream, attracting investors and traders from all walks of life. With the potential for high returns, many individuals are eager to make money trading cryptocurrency. But what exactly does this entail?

Cryptocurrency trading involves buying and selling digital currencies, with the aim of benefiting from price fluctuations. Unlike traditional fiat money, cryptocurrencies operate on a decentralized network, with Bitcoin, Ethereum, and Ripple being some of the most recognized assets in the market.

Why Trade Cryptocurrencies?

There are several reasons why traders flock to the cryptocurrency market:

- High Volatility: Cryptocurrency prices can fluctuate wildly in short periods, providing opportunities for significant profits.

- 24/7 Market: Unlike stock markets, crypto markets operate around the clock, allowing you to trade at any time.

- Diverse Options: With thousands of cryptocurrencies available, traders can create diversified portfolios.

- Innovative Technology: Engaging with blockchain technology and decentralized finance (DeFi) opens new avenues for investment.

Understanding the Basics of Cryptocurrency Trading

To make money trading cryptocurrency, you need to understand some fundamental concepts:

1. Cryptocurrency Exchanges

Exchanges are platforms where you can buy, sell, and trade cryptocurrencies. Some of the most popular exchanges include Binance, Coinbase, and Kraken. Each platform has its unique features, so it's essential to choose one that suits your trading style and requirements.

2. Wallets

A cryptocurrency wallet is crucial for storing your assets securely. There are two primary types of wallets:

- Hot Wallets: These are connected to the internet and are more convenient for frequent trading.

- Cold Wallets: These are offline storage solutions, providing enhanced security against hacks and breaches.

3. Trading Pairs

Trading pairs, such as BTC/USD or ETH/BTC, indicate the exchange rate between two cryptocurrencies. Understanding these pairs is vital for making informed trading decisions.

Developing a Trading Strategy

To maximize your profits and minimize risks, it's essential to develop a solid trading strategy. Here are several approaches you can take:

1. Day Trading

This strategy involves making multiple trades within a single day, capitalizing on small price movements. Successful day traders need to be attentive to market trends and news.

2. Swing Trading

Swing trading focuses on capturing short- to medium-term gains in an asset over a few days to weeks. This approach requires a good understanding of market trends and technical analysis.

3. HODLing

Originating from a misspelled forum post, HODL signifies a long-term investment strategy where traders hold onto their assets regardless of market fluctuations, betting on future growth.

4. Scalping

Scalping involves making numerous trades throughout the day to exploit small price gaps. This requires precision and a keen understanding of market behaviors.

Analyzing the Market

To succeed in cryptocurrency trading, robust analysis is critical. Here are the main analytical methods:

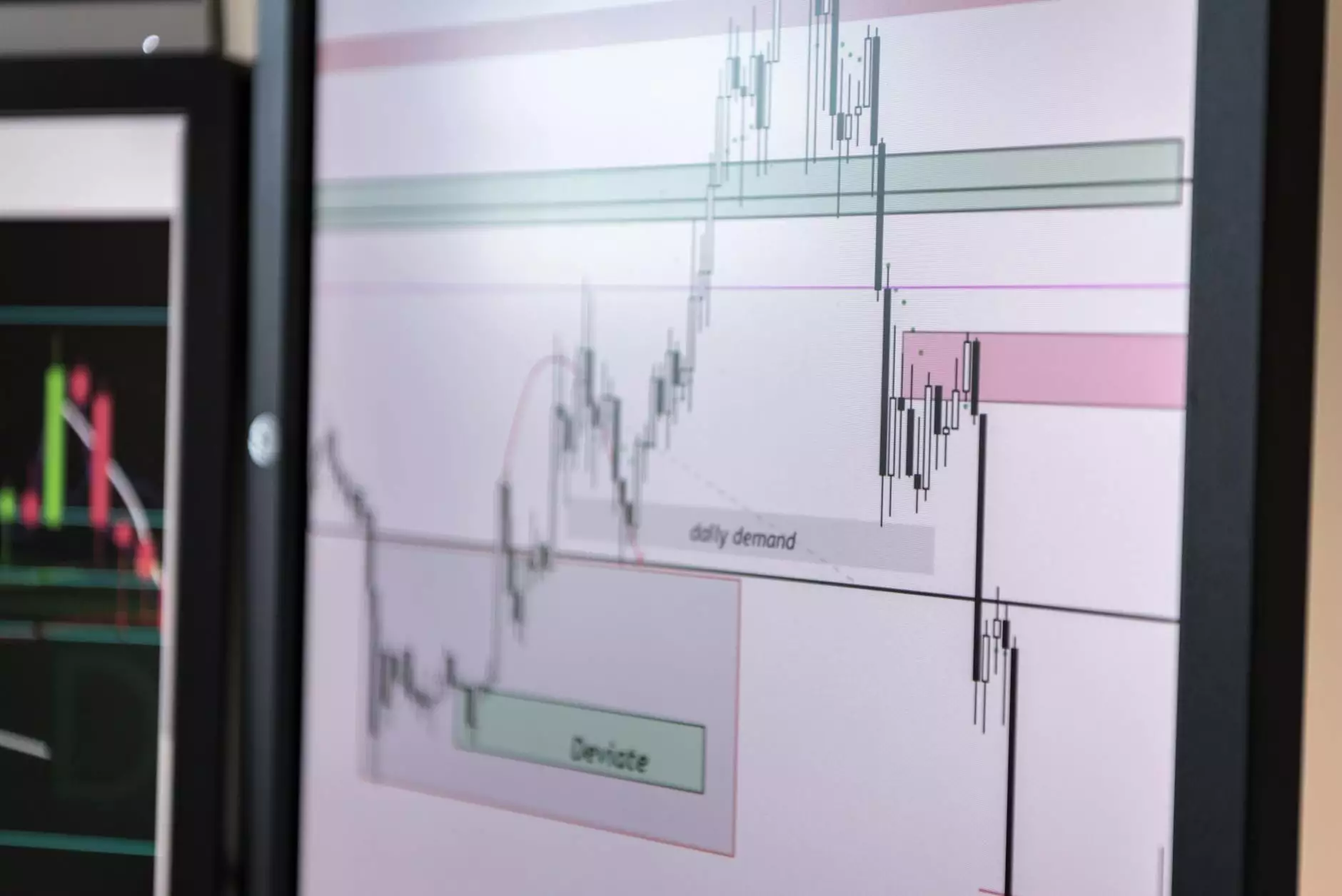

1. Technical Analysis

Technical analysis (TA) involves evaluating historical price and volume data using charts to predict future price movements. Traders use various indicators, such as moving averages, RSI, and MACD, to make informed predictions.

2. Fundamental Analysis

Fundamental analysis (FA) looks at the underlying factors affecting the value of a cryptocurrency. This includes evaluating market trends, technological advancements, news events, and overall adoption rates.

Risk Management in Cryptocurrency Trading

Effective risk management is essential for safeguarding your investments. Here are some strategies to consider:

- Set Stop-Loss Orders: This automated tool exits your position at a predetermined price to limit potential losses.

- Diversify Your Portfolio: Holding different cryptocurrencies can reduce overall risk.

- Only Invest What You Can Afford to Lose: Ensure that your investments won't jeopardize your financial stability.

Emotional Discipline and Trading Psychology

Cryptocurrency trading can be emotionally taxing. Developing emotional discipline is crucial for trading success. Strategies include:

- Avoiding FOMO: Fear of missing out can lead to impulsive decisions and losses.

- Sticking to Your Strategy: Following a well-defined trading plan helps reduce emotional influences.

- Taking Breaks: Stepping away from the market can prevent emotional trading and burnout.

The Future of Cryptocurrency Trading

The cryptocurrency market continues to evolve rapidly, with innovative technologies, regulatory changes, and increasing institutional involvement shaping its future. Staying informed and adapting to market developments is vital for anyone looking to make money trading cryptocurrency.

Additionally, trends like decentralized finance (DeFi) and non-fungible tokens (NFTs) are creating new trading opportunities and potential avenues for profitability.

Conclusion

In conclusion, while making money trading cryptocurrency is achievable, it requires education, strategies, and emotional discipline. With the right tools and knowledge at your disposal, anyone can navigate this exciting market. At monetizevirtualfunds.software, we provide a wealth of resources to help you refine your trading skills and enhance your financial success in the cryptocurrency space.